We Made a Commercial!

Newsletter

Read the latest edition of MNBnews.

Articles

{beginAccordion h3}

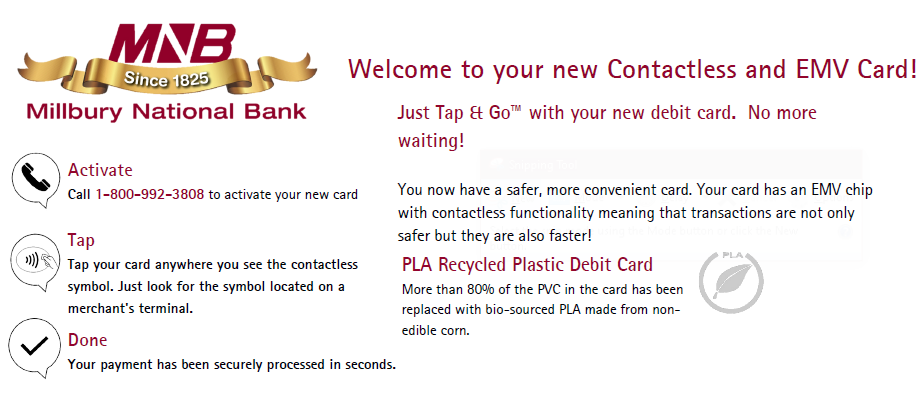

New Contactless and EMV Cards!

We are pleased to announce that we will begin issuing our new Contactless EMV cards.

How to Pay Your MNB Loan

We offer loan payment options tailored to fit any preference- cash or check, auto deduct or online!

Pay by Cash or Check:

- Send a check by mail, ATTN: Loan Dept, for us to apply the payment to your loan

- Deposit a check by using the mobile deposit feature on our app. Complete by selecting your loan account in the "Deposit To" dropdown

- Pay with cash or check at MNB

Pay with Auto-Deduct:

- Open and maintain an active checking or savings account with Millbury National Bank and you can set up your payment to be automatically deducted from the account

Pay Online:

- Visit our website and pay with a debit or credit card or initiate an ACH payment directly from any financial institution*

- Select Loans > Pay Your Loan > Click OK to confirm > Input your info > Submit

- Or go right to the payment portal:

- Pay-by Link - Finli

- Register your online banking profile

- Complete a transfer from an existing MNB checking or savings account to your loan via:

- Internet banking

- Millbury National Bank Mobile, our mobile app

- Utilize our mobile deposit feature on our app

- Complete a transfer from an existing MNB checking or savings account to your loan via:

*fees may apply

How to Rebuild Your Credit

Is poor credit keeping you from achieving your goals of purchasing a house or that new car? There’s good news! Your credit doesn’t have to stand in your way forever. While certain credit mishaps will stay on your credit report for seven years, and bankruptcies can linger for ten years, there are several simple steps that you can take to start rebuilding your credit right away!

The first step that you should take is to begin paying your existing debt on time going forward. What happened in the past should stay there, but your credit score will thank you when you make payments on time. The goal should be to keep your balance, especially on credit cards, low. The definition of ‘Low’ usually means you are utilizing less than 30% of your available credit. For example, if your credit card has $1,000 limit, it is best to keep a balance of $300 or less on it.

A secondary option that Millbury National Bank would love to assist you with is opening a cash secured loan. When establishing a cash secured loan, you are creating the opportunity to have consistent and timely Installment Loan payments reported to the credit bureau. The best part about this type of loan is that you can obtain it even with poor credit history. With a cash secured loan, there is no need for you to sign over any of your own money as collateral, since the proceeds from the loan are used to secure the Note. Once you have repaid the loan in full, the proceeds that were being held as collateral will be released and put into your pocket so you can get back to focusing on step number one!

Lastly, but equally as important, is to practice good financial habits. Nothing that was previously talked about will work if you are unable to be honest with yourself about your spending limits. Take a hard look at your own personal finances and budget to see if you can eliminate unwanted or unused bills that you pay for monthly. Have a gym membership that you haven’t used in a year? Nix it! Cable bill too high? Call your provider and negotiate. They are usually willing to work with you. Your goal should be to pay down all your debts and ultimately pay them off to eliminate them altogether. By doing so, over time your credit score should see a substantial improvement and allow you to achieve your other financial goals!

How To Avoid Overdraft Fees

The dreaded overdraft fee. You forget that you wrote out a check, you don't remember your balance and then all of a sudden the forgotten item hits your account and you get assessed an overdraft fee. We understand that life gets busy and mistakes happen. To better help manage your accounts and avoid any potential fees, Millbury National Bank offers several helpful tools including internet banking (which can be accessed using your computer, smart phone or tablet), telephone banking, sweep transfers and a cash reserve for overdraft protection. To decide which products are the right fit for you, call Millbury National Bank and speak to any of our knowledgeable bankers. We are here to answer your questions and assist you with any of your account needs. Let us help you better manage your account!

Protect Your Personal Information with Kasasa Protect

With identity theft on the rise at an alarming rate, many of us have had some sort of personal information compromised at some point. In 2016, identity theft affected 15.4 million Americans, stealing more than $16 billion; a 16% increase from 2015. Some examples may include debit card fraud, falsified or multiple tax returns using your personal social security number, or even something as strange as someone stealing your Facebook profile picture to create additional accounts. With activities like this going on all around us, it can be easy to be scared of being the next victim of identity theft every time you step out into the public. However, there are ways to combat identity theft. One of the best ways to do that is with Kasasa Protect. Kasasa Protect acts like a bank vault for your personal information, keeping it safe and secure for your peace of mind.

Kasasa Protect employs around-the-clock monitoring for fraudulent activity and will alert you immediately if there is any suspicious activity. Additional features of this tremendous service include 24/7 credit monitoring, with access to annual credit reports with a monthly credit score and tracker. Kasasa Protect will monitor the dark web and scan millions of international sources in real time to help spot stolen data such as social security numbers. One of the best features is that in the event that fraud or identity theft occurs to you, certified specialists will go to work filing, disputing and helping resolve issue with your credit report and other authorities, if needed. In addition, while you can never be completely safe, Kasasa Protect is the next best thing to provide yourself with peace of mind, knowing that your personal information is being monitored and protected by specialists! Inquire with our knowledgeable staff on how to make the most out of this service!

{endAccordion}